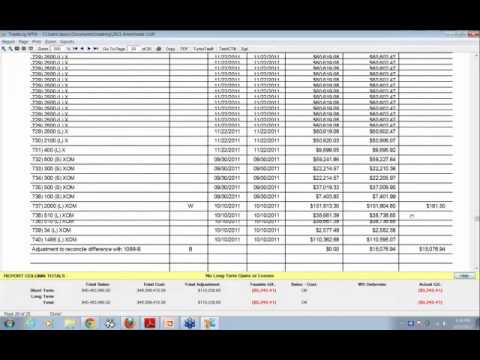

Okay, so we have some requirements that we need to discuss today. Specifically, we will be talking about form 8949, which is used by those who are filing a 1040 Schedule D. If this does not apply to you and you are filing under the mark-to-market accounting method or filing a 1065 Schedule D, then this class may not be suitable for you. You can choose to leave or stick around, it's up to you. I just don't want to waste your time. Before we continue, it's important that you are already using trade log and have the latest version installed on your computer. We have made a few updates to version 9.1, so please make sure you are up-to-date. Additionally, you will need your broker 1099 B in order to complete the steps we will be discussing. If you haven't received your broker 1099 B yet, that's okay. You can still follow along and once you receive it, you can complete these steps on your software. I understand that some of you may still be waiting for your 1099 B's or even a corrected 1099 D. When those arrive, you can finish the steps we are discussing. Today, we will be focusing on steps five through eight of our QuickStart guide. Please note that steps one through four of the QuickStart guide cover importing your trade history and verifying your open positions. It's important to have completed those steps before proceeding with the ones we will be discussing today. However, if you haven't done those steps yet, you can still stay with us and we will explain what we are doing. Just remember to complete those steps before reconciling anything else. Now, let's address a quick question related to different types of filing. Chip, you asked about futures. Futures...

Award-winning PDF software

1099-b 2025 Form: What You Should Know

Forms must be completed prior to filing on the 1099-B form. Ir's 1099b b 2017.pdf — IRS Get the Form 1099-B 2025 in Word, Word and PDF. Do you have information to share about this or anything I just said? Email me.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1099-B, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1099-B online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1099-B by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1099-B from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1099-b 2025