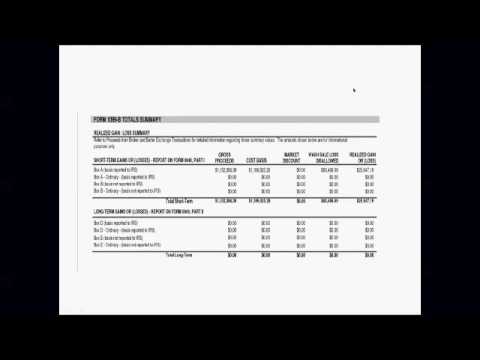

This was a 1099 B that would brought to our attention this morning to go over and I know the house is some time researching it and figuring it out and wanted to share that so how it's all yours okay so it's typically really easy except for kind of one thing so when you get the 1099 and the one I'm looking at it's all short-term gains or losses so there's a summary page and it says it's all box day stuff and so it's got gross proceeds and it's got cost basis and you've got about a hundred and almost 120 pages of detail you don't need to put all that detail in your tax return oh all we do is we put in in this case Apex clearing short-term transactions and we put in the total of the gross proceeds and that's what the IRS computer will match is the total of gross proceeds and then normally we just put in the cost basis now if like this one you've got wash sale loss disallowed that's the complication see that you've got to look at here and you've got to adjust for so let's talk for a minute about wash sales so wash sales are defined as buying or selling a security at a loss when within the 30 days before the date of the sale and 30 days after the date of the sale you've purchased that same security so let me give an example let's assume that on November 30th I sell Bank of America at a loss but I'd also purchased other Bank of America stock the 30 days before that and within the 30 days after that if I've got a gain there's no impact but if I've got a loss on that...

Award-winning PDF software

When to file 1099-B Form: What You Should Know

If you sell shares of a stock on your broker's exchange, use Form 1099-B to report this transaction. If you sell commodities or debt instruments, use the Form 1099-B to report the transaction. If you sell foreign currency and have an outstanding bill of exchange that is payable to a foreign country, report the purchase of such currency on a Form 1099-B. Example: If you sold 1,500 shares of stock on a New York Stock Exchange (NYSE) exchange for 2,000, then you did not sell the securities for anything in real money. You bought them for nothing as “Brokers' Securities.” Your gain or loss from that purchase is 100. Now, you would report 100 as taxable income and 5,000 as a charitable contribution for U.S. foreign charities. If you bought such securities on an IRS-facilitated online market (such as through Trade) and held them the entire time, then such transactions are treated as short-term barter transactions. The IRS will send you Form 1099-B showing your gain or loss from this transaction. If you purchased such securities via an electronic market (e.g., through Trade) in cash, you would report the transaction in the year of sale. The gain or loss from such purchase generally would be taxed at the greatest of the tax rate for such a short-term barter transaction, or the tax rate for the year you sold them. Example: You bought 3,500 shares of stock on a New York Stock Exchange (NYSE) or NYSE Area exchange and held them the entire time. The NYSE Area or NYSE NY WTC exchange is a short-term electronic market. This transaction is considered to be a barter transaction with each share of stock costing 2.01 each, and thus the gain or loss would be taxed at the least of the ordinary income tax rate, or the tax rate based on the current tax year's tax basis for your 3,500 shares of stock (the current year is the calendar year to reflect the tax basis of your 3,500 shares of stock). If your NYSE NY WTC exchange is a designated market for trading shares of U.S. treasury securities (which is why it carries the label “Treasury”), then you are required to file Form 8829, and you would also report the gain or loss in the year of sale.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1099-B, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1099-B online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1099-B by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1099-B from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing When to file Form 1099-B